By David Dodge and Kay Rollans

Norman Crowley is a capitalist with on a mission to solve climate change—by 2030. CEO of the Cool Planet Group and Crowley Carbon, Crowley is the poster boy for climate capitalism in the world today.

The name of Crowley’s game is efficiency, both from a business and a carbon footprint perspective.

“We waste $1.2 trillion of energy. We create this incredibly precious resource [energy], we damage the planet doing it and then we waste 70 per cent of it,” Crowley tells Green Energy Futures in an interview from his home in Cork, Ireland.

His vision is to help big business reduce their waste—and increase their bottom line. “Our biggest client would save about $150 million annually in wasted energy,” he says.

Birth of a climate capitalist

Whether it’s in commerce, video gaming, or wireless internet, Crowley has a talent building—and selling—successful companies. After selling several particularly lucrative businesses (for a total of nearly $3/4 billion) Crowley decided it was time to throw his talents in with climate movement.

“I’d seen An Inconvenient Truth, and that had stuck with me. And you realize that the world has existential threats, whether that’s climate change, nuclear holocaust or whatever,” says Crowley.

The statistics on global energy waste ($1.2 trillion per year) stunned him into action. “I just decided that it would be good to spend my time doing what I could on that, but also doing it through the expression that I have, which is business.”

“I didn’t want to do another 10 or 20 years of a start-up without it having any meaning.”

Crowley began creating the Cool Planet Group, a group of companies that together are like a one-stop-shop for reducing carbon and energy use. But he recognized right away that selling “energy efficiency” was going to be a challenge.

The problem with energy efficiency, Crowley says, is that you aren’t creating an energy product to sell. “You are just not wasting it.”

No money? No problem.

Energy efficiency is a spend-money-to-save-money kind of endeavour—and it can be a hard sell. Crowley says you have to be commercially savvy to help businesses understand and engage with energy efficiency.

Even though energy efficiency is well recognized as a way for big business to save big money and increase competitiveness, Crowley says the most common excuse he hears for not investing in energy efficiency is “I don’t have money.”

For Crowley, the best response to this complaint is simply to look at the numbers.

“Look, if I can save you 100 million bucks on a two-year payback, that’s a 50 per cent return on your money. And so if you can borrow money at two per cent and I’m giving you a 50 per cent return, then I’m sure you have money,” he reasons.

All it takes is a bit of creative thinking to get the cash flow to work out right.

Crowley described working with one Canadian company that needed to replace boilers to achieve environmental compliance.

“The boilers were going to cost $12 million. The payback on that was going to be stupidly long, but there was a whole load of other stuff that was way shorter payback.” So, Crowley blended the boilers into a package with some high-payback energy efficiency upgrades (such as load shifting), and saved the company $3 million in operating costs per year.

The project reached a three-year payback and energy efficiency paid the way.

To make investing in energy efficiency as painless as possible, Crowley brings technology, capital and even insurance to the table to assuage their short-term financing anxiety to achieve long-term energy efficiency savings.

To guarantee returns for his clients, the Cool Planet Group includes not only Crowley Carbon, but Cool Planet Capital (which covers financing) and Crowley Carbon Real Safe (which provides insurance).

He even offers to share savings with clients when they don’t have money: “If you don’t have money, then we do what’s called shared savings….[W]e partner with big financial institutions. And we say to you, ‘look, if we’re going to save you 50 million bucks, how about we take 25, you take 25, and then after five or seven years, you can take all the money.’”

This integrated and creative approach has earned him some of the top business clients in the world. “Thankfully, four of the top five food companies in the world work with us. Seven of the top eight pharmaceutical companies, a lot of oil and gas companies. So, you know, and thankfully, there’s a lot of business out there.”

Climate change solved by 2030?

“What is it you believe that almost nobody else does?”

For Crowley, this question—which he borrows from PayPal founder and wildly successful investor Peter Thiel—is the secret to making successful business decisions with the power to change the world.

“I believe climate change will be resolved by 2030,” says Crowley. “And it’s got nothing to do with governments or regulation, because if it had to do with governments and regulations, we would still be here in 2100. It has to do with economics.”

For Crowley, all we need to do to address climate change today is follow the money.

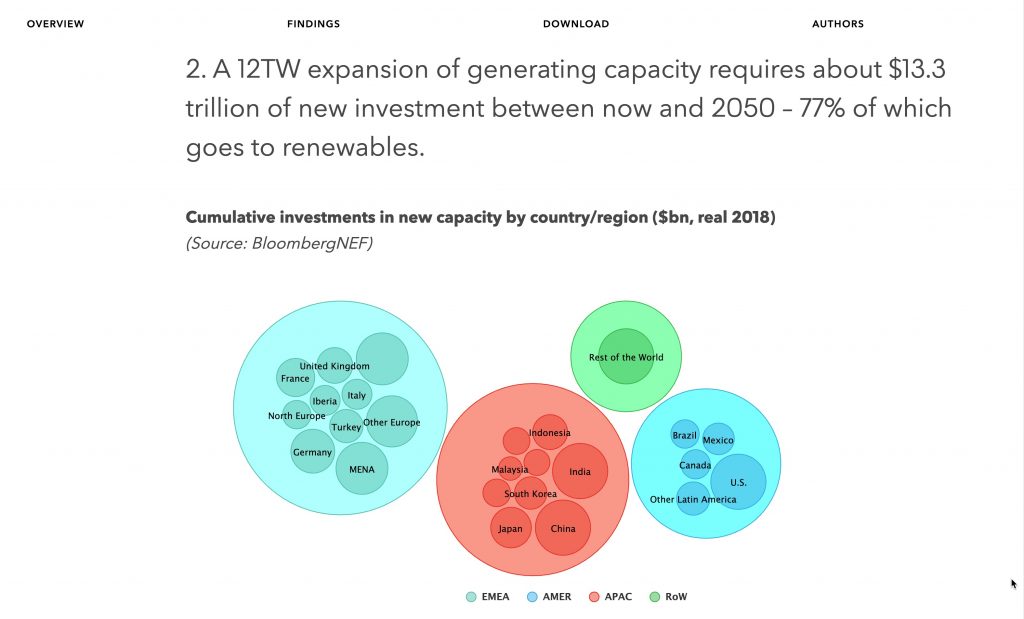

It’s not a far-fetched idea. In fact, we’re already seeing massive economic transition to low carbon industries. Car companies are investing $300 billion into efficient battery development and new electric cars. They are creating more than 700 models of electric vehicles most of which are due on the market by 2025. Renewable energy is already the cheapest energy money can buy, and Bloomberg predicts 77 per cent of all global investment ($13.3 trillion) in power generation will be in renewables between now and 2050.

In fact, Crowley says Bloomberg’s predictions—and others like them—are too conservative. They ignore, he says, precipitous economic events that are and will speed the transition to energy efficiency and green alternatives.

According to current projections, coal will still be with us at 2040. But already, Crowley says, no bank will bankroll coal plants due to risk and cost—and “if nobody’s buying the coal plant…then you can’t have one.”

“Precipitous events are happening by the second,” he says. “We have oil and gas companies that are clients of ours that publicly announced this year that they will not have dividends anymore.”

This, Crowley says means big pension funds cannot hold oil and gas stocks which in turn will accelerate the transition to low carbon energy.

This coupled with the migration of capital to low carbon industries means an accelerated transition and for people like Crowley huge economic opportunities.

Energy, transportation, and food: The 80/20 rule

Crowley believes we vastly underestimate the impact of these precipitous economic events

“It’s the classic 80/20 rule,” he says—a basic rule of investing that 20 per cent of investment inputs will result in 80 per cent of the outputs. For Crowley, this means that if we tackle the top 20 per cent of climate issues, “we’re done.”

The top three problems? Energy, transportation, and food. And there’s a huge global push towards solving them all.“ There is a wall of private equity money—6.3 trillion over the next five years—going into these opportunities,” says Crowley.

Energy, he says, is in the bag. “During COVID a couple of PPAs [power purchase agreements] were announced…for solar and battery – and they were at between one and two cents a kilowatt hour,” says Crowley.

Economics now favour zero carbon energy and costs are expected to go down further.

In the transportation sector the future is electric and its coming faster than anyone imagined.

“If you’re in any way financially astute and you look at the data around electric cars and you think ICE [internal combustion engines] are going to be OK past 2030, you are not a good person at judging numbers because all of the graphs are going in one direction right now.”

Moreover, Crowley says that a revolution in food production is already underway.

“There’s a company called Solar Foods in Finland and they are creating…protein. They’re creating a powder that’s 70 per cent protein, 20 per cent carbs, 10 per cent fats, and some other things out of thin air. It’s 10 times cheaper than dairy protein powder,” says Crowley.

Such innovations would allow us to produce protein with a massively reduced carbon footprint, a lot less land, and many fewer inputs such as fertilizers.

Crowley also predicts these innovations will lead to a surge in meat alternatives that will cost less and less over time. He’s so enthused by the possibilities; he’s also starting a new company to compete in the Beyond Meat space.

Whether or not climate change is solved by climate capitalists by 2030 is still an open question—but there’s no question that there is a lot more economic momentum moving towards a low carbon energy transition than most people realize.

We interviewed Norman Crowley from his home/office in Cork, Ireland. In Part II of our series on Climate Capitalism we look at Crowley’s new electric vehicle start-up.