By David Dodge and Duncan Kinney

When it comes to solar panel manufacturing the laws of supply and demand may as well be Heisenberg’s uncertainty principle.

Just ask the former president of one of the largest solar photovoltaic module manufacturers in Canada.

“You know we’ve coined the phrase solar rollercoaster, it’s had a lot of great moments and a lot of pretty low moments, but it’s been a great ride,” says Milfred Hammerbacher, the ex-president of Canadian Solar Solutions.

As countries all over the world grapple with how best to build out the next generation of clean, green electricity generation infrastructure they oscillate between wanting as much as they can get as soon as possible and industry collapse.

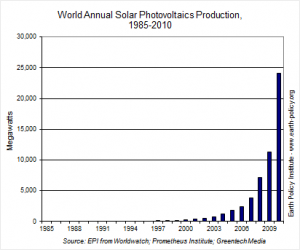

While these bubbles can be locally catastrophic when it comes to jobs and investment the numbers for the world wide production of solar panels look like a simple exponential function from your high school math class.

If you’re a data hound, here is the spreadsheet that was used to create that graph

That graph comes about via the work of manufacturers like Canadian Solar, the parent company of Canadian Solar Solutions. Based in Guelph, Ontario they are one of the largest manufacturers of solar panels in the world. They operate in 11 different countries, made $1.9 billion in revenue in 2011 and shipped 1.32 gigawatts worth of solar panels that same year.

Milfred Hammerbacher is the former president of Canadian Solar Solutions, a subsidiary of Canadian Solar. He’s an affable, friendly guy who got started in the solar industry 24 years ago. His company S2E Technologies is now doing work in Latin America.

Milfred Hammerbacher is the former president of Canadian Solar Solutions and a solar industry veteran.

There was an event that led him to his eventual career: “I was actually in high school during the energy crisis… I wanted to do something to see if I can make a difference and I’ve been at it every since.,” says Hammerbacher.

His company S2E Technologies was hired by Canadian Solar to develop and execute their Ontario business plan. This plan involved more than just manufacturing solar photovoltaic modules. As China has become a manufacturing behemoth in the solar PV space a solar PV module is rapidly becoming a commodity like pork bellies or flat screen TVs.

With that in mind Canadian Solar diversified out into developing and constructing solar power plants.

“By vertically integrating it allowed us to control more of our destiny and push back the margins. It’s also kind of a natural fit, solar modules are the most important part of a solar farm so controlling that whole space has some advantages.”

Moving into engineering, procurement and contracting means that you’re not as dependent on the cruel mistress of supply and demand. This was especially important when the government of Ontario waffled on its feed-in tariff program in the run-up to the latest election.

An example of this kind of project is the Thunder Bay Airport Solar Park in Thunder Bay. It’s a first of its kind – a solar project on airport authority land in Canada and it went live in October of 2011. This 8.5 megawatt solar project was developed and is owned by Skypower.

In June, Canadian Solar acquired a majority interest in 16 Skypower projects that represent 190-200 megawatts.

A solar module on the side of Canadian Solar’s manufacturing plant.

With these projects and partnerships in hand Hammerbacher casually lets it drop that the manufacturing plant has more than a year of work to do on their own projects.

While all this was happening with Canadian Solar the Ontario Government got twitchy about green energy and after delays in announcing version 2.0 of the FIT program the government decided to focus on smaller rooftop systems at the expense of larger, ground-mounted utility scale systems. Projects that would need solar panels manufactured by Canadian Solar

This together with a cap of 50 MW on solar FIT projects spells problems for an Ontario industry that now has the capacity to build 700 megawatts of solar each year.

Not much has been said publicly but according to Hammerbacher “It’s pretty grim for solar companies in Ontario right now.”

Solar Manufacturing Economic Landscape

While Hammerbacher isn’t so bullish on the future, 2011 was a banner year.

According to this report from the federal government (PDF) Ontario accounted for 91 per cent of the 289 megawatts of solar PV that was installed in Canada in 2011.

That report has a bunch of other juicy economic numbers as well

- Leading Canadian PV component manufacturers employed over 2,100 people directly and over 5100 fulltime equivalents;

- In 2011, the Canadian PV industry drove $584 million of economic output and directly employed approximately 5,100 full time equivalents;

- At the end of 2011 total Canadian PV installations of 571 MW could generate 692 GWh per year with a potential value of $50 million per year.

One of the people who helped prepare that report is Jonathan Cheszes and associate director at Navigant Consulting. He used to work with the Ontario Power Authority and helped develop the initial feed-in tariff program. He specializes in the Ontario renewable energy sector and does a lot of market assessment and project risk assessment for investors, lenders and developers.

To put it bluntly the man knows the solar industry in Canada.

Suzanne Wilton shows off one of the panels that Canadian Solar manufactures.

He’s very quick to point out the challenges that the solar PV manufacturers face. Plants are cutting back and consolidating. He sees the diversification and vertical integration of these manufacturers as a necessary step for their survival.

He also separates the Ontario solar market into two broad categories. The larger, vertically integrated giants like MEMC Sun Edison, Canadian Solar and Celestica.

Below them are the smaller companies like Heliene Solar, Eclipsall and OSM Solar who are doing more custom manufacturing for larger international companies.

These companies and these jobs exist because of the domestic content requirement in the Green Energy Act. This requires a certain percentage of solar project costs come from Ontario goods and labour.

These policies definitely help create the solar rollercoaster that Hammerbacher talked about, but with every gigawatt of solar photovoltaic modules that are produced the closer the industry gets closer to sustainability.

“The cost fundamentals have changed so much that it’s bringing the market to a point where it can really almost stand on its own two feet with little or no support in a very short time frame,” says Cheszes.

Caring about how the solar panel got here or where it came from is irrelevant. What we need are cheap, effective and constantly improving solar energy projects. And thankfully, that’s what we’re getting.

As solar approaches grid parity in Germany, Latin America and the Middle East (grid parity is the point at which producing solar power is equal to the cost of getting it from the grid) Hammerbacher expects continued growth over time.

Now working as CEO for his own company S2E Technologies, Hammerbacher is ever hopeful: “In the early 1900s there were 200 car companies in Detroit. The car industry didn’t die, it consolidated and continued.”

While there might be short term pain, the long term gain means consumers everywhere get access to cheap, plentiful and constantly improving solar panels.

-30-

[flickrshow:72157631692991361,width=625]